riverside mo sales tax rate

Title And Registration Secrets Watch This Video Before You Register Your Flipper Car no sales tax due letter mo Request for Certificate of No Sales Tax Due no sales tax due letter mo No Tax Due Tutorial no. Riverside in Missouri has a tax rate of 66 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Riverside totaling 237.

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The Riverside Missouri sales tax is 660 consisting of 423 Missouri state sales tax and 238 Riverside local sales taxesThe local sales tax consists of a.

. The County sales tax rate is. Use the Sales and Use Tax Tables and Charts. If you have suggestions comments or questions about the Sales Tax Rate Information System please e-mail us at salesusedor.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax. Did South Dakota v. Indicates required field.

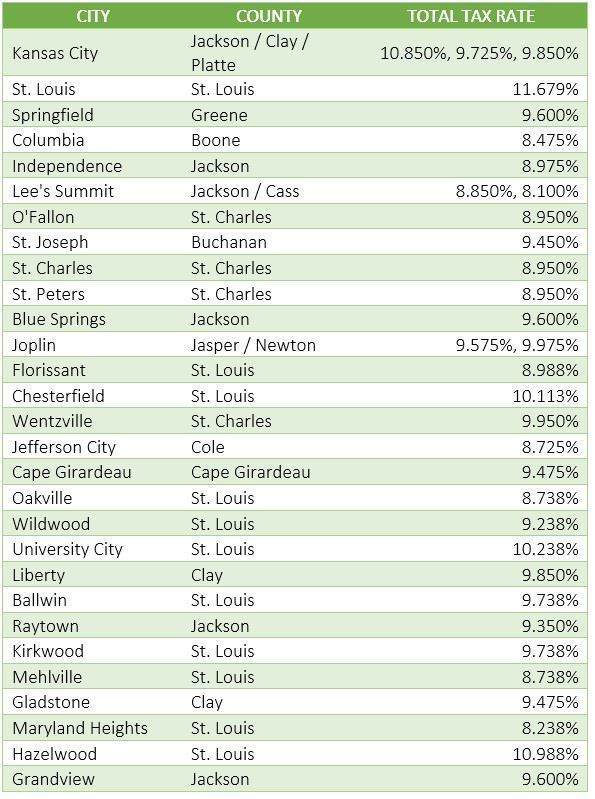

The Missouri sales tax rate is currently. The Riverside sales tax rate is. The 885 sales tax rate in Kansas City consists of 4225 Missouri state sales tax 125 Jackson County sales tax 325 Kansas City tax and 0125 Special tax.

Riverside California and Kansas City Missouri. Tax Rates for Riverside - The Sales Tax Rate for Riverside is 66. One of a suite of free online calculators provided by the team at iCalculator.

E-mail us at salesusedormogov or. Call the Department at 573-751-2836. Riverside has seen the job market increase by 13 over the last year.

Mogov State of Missouri. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Riverside MO. The Riverside Missouri Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Riverside Missouri in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Riverside Missouri.

Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property. The December 2020. Show sales tax revenue overall growth for cole county news tribune ALERT.

To obtain the sales tax rate information for a general area rather than a specific address you may. - The Income Tax Rate for Riverside is 59. The US average is 73.

4 rows The current total local sales tax rate in Riverside MO is 6600. The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail. No Sales Tax Due Letter Mo.

2022 Cost of Living Calculator for Taxes. You can print a 885 sales tax table here. The current total local sales tax rate in Riverview MO is 8238The December 2020 total local sales tax rate was 8113.

Future job growth over the next ten years is predicted to be 360 which is higher than the US average of 335. The sale of tax lien certificates is a solution to a complex problem Platte County Missouri recovers lost revenue needed to fund local services the property owner gets more time to satisfy their delinquent property tax bill and the purchaser receives a tax lien certificate which is real estate secured and offers up to 10 per annum 8 on. 075 lower than the maximum sales tax in MO.

For tax rates in other cities see Missouri sales taxes by city and county. Sales tax rate in Riverside Missouri is 6600. 4 rows The 71 sales tax rate in Riverside consists of 4225 Missouri state sales tax.

The 2018 United States Supreme Court decision in South Dakota v. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Tax rates are provided by Avalara and updated monthly.

One of a suite of free online calculators provided by the team at iCalculator. Use tax is imposed on the storage use or consumption of tangible personal property in this state. Has impacted many state nexus laws and sales tax collection requirements.

Wayfair Inc affect Missouri. Riverview MO Sales Tax Rate. The Raytown Missouri sales tax is 835 consisting of 423 Missouri state sales tax and 413 Raytown local sales taxesThe local sales tax consists of a 125 county sales tax a 275 city sales tax and a 013 special district sales tax used to fund transportation districts local attractions etc.

See how we can help improve your knowledge of Math. The US average is 46. The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent.

Look up 2021 sales tax rates for Riverview Missouri and surrounding areas. Find Sales and Use Tax Rates Enter your street address and city or zip code to view the sales and use tax rate information for your address. The Raytown Sales Tax is collected by the merchant on all qualifying sales.

Missouri State Taxes For 2022 Tax Season Forbes Advisor

2013 2022 Form Mo Dor 2760 Fill Online Printable Fillable Blank Pdffiller

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Missouri Sales Tax Small Business Guide Truic

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Missouri Sales Tax Guide For Businesses

Missouri Sales Tax Rates By City County 2022

Quick Tax How To Videos Kcmo Gov City Of Kansas City Mo

Quick Tax How To Videos Kcmo Gov City Of Kansas City Mo

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Missouri Car Sales Tax Calculator

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders